We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

BAE Systems sees jump in sales and profits

Image source, Katsuhiko Tokunaga

BAE Systems, the defence, aerospace and electronics giant, has seen a rise in both sales and profits for 2015.

from ôÈ1.3bn to ôÈ1.5bn while sales increased by ôÈ1.3bn to ôÈ17.9bn.

Sales were helped by the delivery of Typhoon fighter jets to Saudi Arabia.

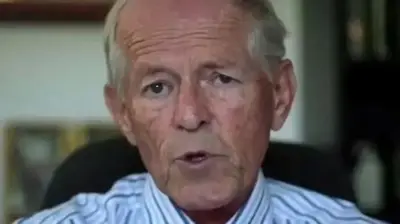

The company's chief executive, Ian King, said the group was well placed to continue to generate attractive returns for shareholders as "defence budgets recover".

In recent years, the company has seen a squeeze on defence spending.

BAE is also expanding into provision of cyber security for major corporations, including banks and telecoms.

'Solid performance'

BAE's cyber and intelligence division consists of the US-based Intelligence & Security and Applied Intelligence in the UK. Overall the division's sales increased by 3% to ôÈ1.8bn.

Applied Intelligence saw sales rise by 31%, 13% of which was as a result of the acquisition of cyber security company SilverSky, with the rest coming mainly from commercial customers in the UK.

BAE predicts sales will continue to go up as cyber security becomes increasingly important for both governments and commercial organisations.

In its statement BAE said it had delivered another year of "solid performance" and "resilience in markets constrained by wider economic pressures".

Defence spending

It highlighted, in particular, the increased Typhoon deliveries to Saudi Arabia, plus sales from the trading of equipment on the European Typhoon programme, as well as more naval business.

In the UK, BAE said government commitments to "protect defence and security spend, in a still tightly constrained UK economic environment, were helpful".

As part of its Strategic Defence and Security Review in November 2015, the government said it would continue to invest in expanding the capabilities of BAE's Typhoon fighter jets and extend the aircraft's service life until at least 2040.

And in the US, the government announced plans to increase spending on defence in both 2016 and 2017 and BAE says it expects to benefit from that.

'Inflection point'

"Defence markets have been tough for years, but may now see some improvement as austerity eases, says Steve Clayton, head of equity research at Hargreaves Lansdown.

"Defence companies will never be redundant, we fear, but we may be at an inflection point, where their traditional weapon platforms, tanks, jets, subs and missiles, are less important than data processing and surveillance capabilities.

"Cyber security, both national and commercial is an area BAE is keen to grow, but it is not yet big enough in the business to drive the overall group forward on its own," he adds.

Earlier this week, BAE announced the appointment of Charles Woodburn to the newly created role of chief operating officer, with the expectation that he would take over as chief executive in about 18 months.

Shares in BAE closed up 1.14% on Thursday.

Top Stories

More to explore

Most read

Content is not available