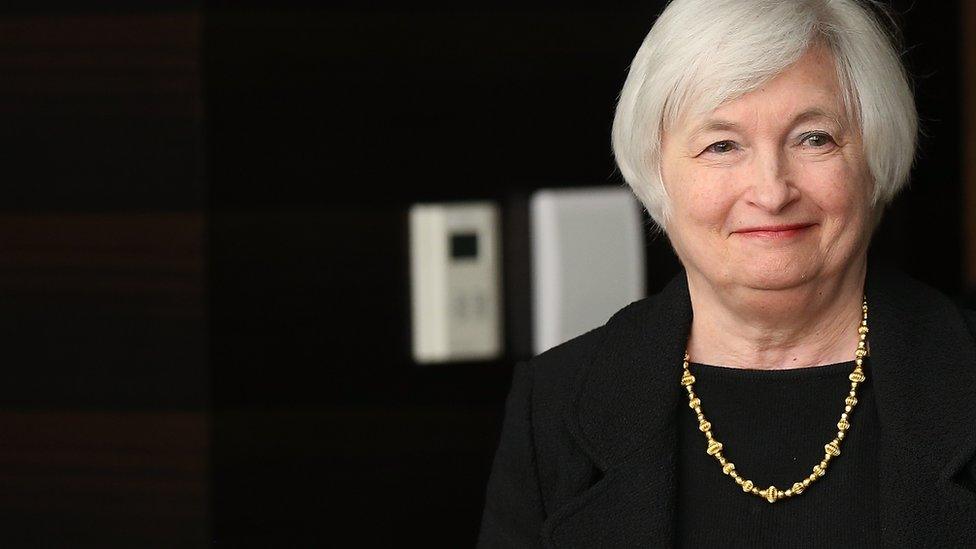

Janet Yellen defends US regulations

- Published

Federal Reserve Chair Janet Yellen defended financial rules introduced to the US after the 2008-2009 financial crisis, backing policies that President Donald Trump has deemed "a disaster".

The Trump administration has said the rules have stifled economic growth and lending.

It is working with Republicans in Congress and financial firms to roll back some regulations.

Ms Yellen said the bank was open to changes but they should remain modest.

Ms Yellen spoke in Jackson Hole, Wyoming, where top economists and central bankers have gathered for an annual conference.

Republicans take aim at Dodd-Frank financial rules

"The evidence shows that reforms since the crisis have made the financial system substantially safer," Ms Yellen said in her remarks.

The regulations included new consumer protection measures and requirements that firms have more cash on hand in the event of a crisis. Authorities also received powers to wind down major financial institutions.

Ms Yellen, whose term is due to expire early next year, rejected arguments that the rules are to blame for the relatively slow recovery from the crisis, while conceding that some areas could be improved.

The Federal Reserve is looking at changes to ease regulations for smaller banks, she said.

There may also be benefits to modifying the so-called Volcker Rule, which limits the ability of large banks to trade with their own money, she added.

But Ms Yellen cautioned against any sweeping rollback: "The balance of research suggests that the core reforms we have put in place have substantially boosted resilience without unduly limiting credit availability or economic growth."

Tenure in Washington?

Ms Yellen's speech did not address speculation about her tenure. In July, she told Congress that staying on had not come up in conversations with the president.

Appointed by former President Barack Obama, Ms Yellen is viewed as a less conservative economist than some others at the bank, with a focus on economic growth rather than inflation.

Mark Hamrick, a senior economic analyst for Bankrate.com, said the remarks are likely to have little impact on the debate in Washington, where the banking rules known as Dodd-Frank are viewed as anathema by many Republicans.

"Despite her urging that any future adjustments to post-crisis financial reforms be only modest, her defence of financial reforms in the wake of the financial crisis that hit its zenith a decade ago will not largely... change minds in the Congress," he said.

- Published25 August 2017