Xerox boss and executives ousted in Fujifilm merger row

- Published

Two executives close to Carl Icahn will be installed in key roles

The boss of Xerox and six board members will step down after the firm reached a deal with major shareholders who opposed a takeover by Japan's Fujifilm.

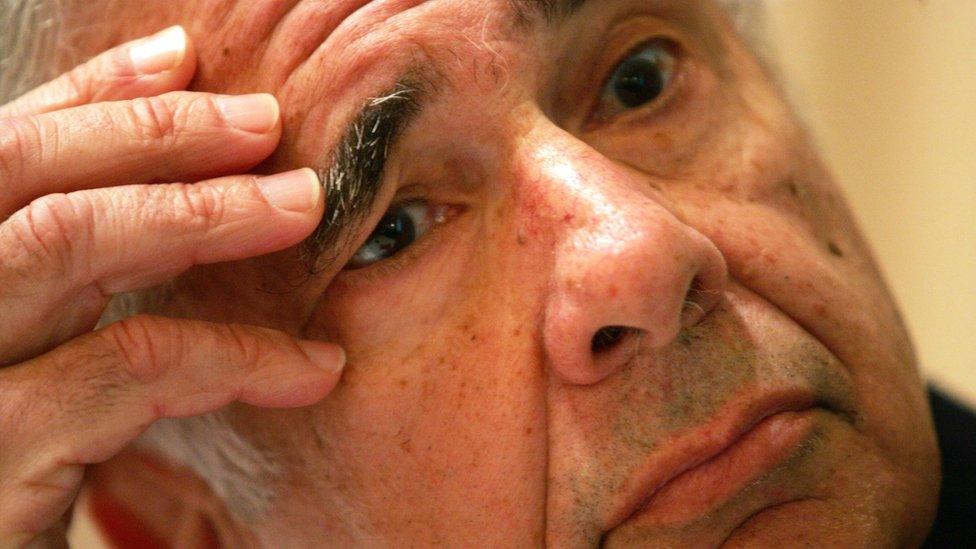

Investors Carl Icahn and Darwin Deason, who together own 15% of Xerox, argued that the $6.1bn (┬г4.5bn) merger undervalued the company.

As part of the settlement, chief executive Jeff Jacobson will resign.

Xerox shares fell 3% on news of the shake-up which follows a court decision last week to temporarily halt the deal.

The boardroom clear-out paves the way for two executives close to Mr Icahn to be installed as chief executive and chairman.

John Visentin will take on the role of chief executive after being retained by Mr Icahn as a consultant in March.

Keith Cozza, chief executive of Icahn Enterprises, will become chairman of Xerox.

The two companies had agreed to the joint venture in January but that deal appears to be under threat.

Fujifilm will appeal

Last week, a New York judge's ruling put a temporary block on the agreement.

Fujifilm says it will appeal and plans to file an objection against the Xerox settlement with its key shareholders.

"We have serious concerns about the announced settlement and we intend to file our objections with the court shortly," the firm said in a statement.

Under the plan, the combined company would be called "New Fuji Xerox" and would be 50.1% owned by Fujifilm.

When the deal first emerged, the Japanese technology firm said it planned to cut 10,000 jobs by 2020 at its Fuji Xerox subsidiary as it was facing "an increasingly severe" market.

- Published31 January 2018