One year left for PPI compensation claims

- Published

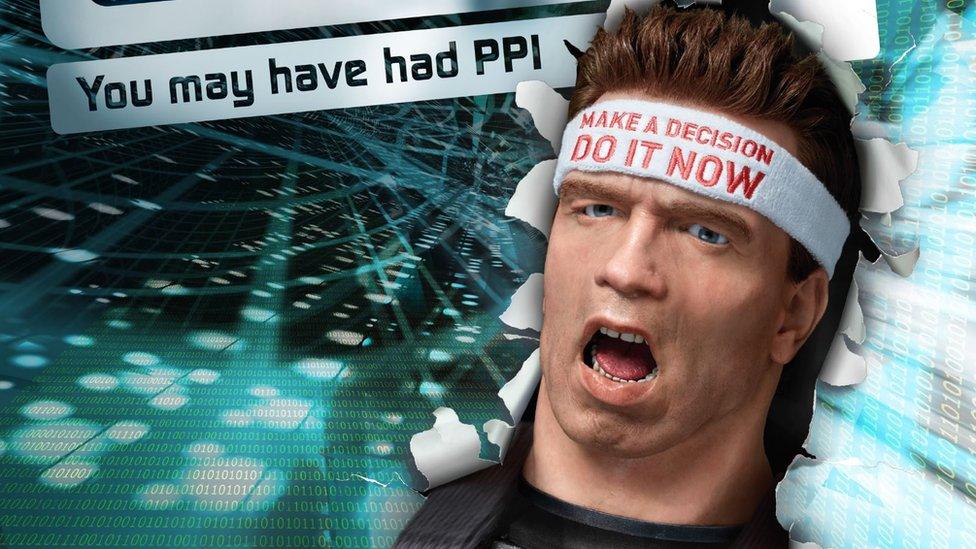

Arnold Schwarzenegger's head featured in some FCA adverts

Loan customers mis-sold payment protection insurance (PPI) have exactly a year left to make a claim for compensation.

The Financial Conduct Authority (FCA) set a deadline of 29 August 2019 for the final PPI claims to be made.

So far, 拢31.9bn has been paid out in compensation, with major banks having set aside another 拢10bn or so for future claims.

As many as 64 million PPI policies were sold from as long ago as the 1970s.

The policies were designed to cover loan repayments if borrowers fell ill or lost their job.

Not all of them were mis-sold, but sales were pushed on a huge scale to people who didn't want or need them or who could not use them.

The FCA has been running an advertising campaign, including a demand from the animatronic head of Arnold Schwarzenegger to "do it now", to encourage people to make a claims for compensation if they were mis-sold PPI.

The approaching deadline will prompt more calls from the claims management companies touting for business through calls and texts. They take a cut of any payouts made to claimants who use their services, even though people can make a claim themselves for free.

How to make a claim

More information on PPI and how you can claim is available on the .

A free phone line, managed by the FCA, can be called on 0800 101 8800.

Various templates are also available to download, along with guidance on claiming, on websites such as , , and .

Claims management companies, consumer groups and the regulator are also raising awareness of a Supreme Court case, known as the Plevin case, which means 2.4 million rejected compensation claimants may now be able to make a fresh appeal.

The ruling dealt with the case of a financial company's client not being made aware of a commission being paid when they were sold PPI.

The court agreed that the company's failure to tell its client that it was receiving a large commission for the sale was unfair. The FCA has ruled that banks should have declared the commission if it was over 50%.

If they did not declare it, then the customer is entitled to the return of any commission over 50%, plus interest, even if the PPI was not mis-sold.

This has added extra funds set aside by banks for settling claims.

Banks wanted a earlier deadline for PPI claims and are keen to draw a line under the saga.

- Published4 April 2018

- Published28 July 2017